US citizens and residents need to get in touch with the IRS. Here you will find IRS phone number, assistance of the government agency. You can also go to www.irs.gov to

Telephone Assistance from the IRS: Hotlines and Toll Free Numbers

If you need to speak to an IRS agent about tax-related issues, try telephoning the call center first. The IRS phone number is 800-829-1040 and the lines are open from Monday to Friday between 7am and 7pm (your local time). Please note that this telephone number has been set up to handle individual enquiries.

Find others IRS telephone numbers:

- Business owners can get assistance by calling 800-829-4933 (Monday–Friday, 7am to 7pm).

- If your organization is tax-exempt, you are a government entity, or a retirement plan administrator, please call 877-829-5500. Lines are open from Monday to Friday between 8am and 5pm.

- Individuals who have hearing impairments can contact the IRS through a dedicated TDD telephone line: 800-829-4059.

Before calling IRS, be sure to use the right phone number.

Getting Assistance Online from irs.gov

Like other government agencies, the IRS experiences a high volume of calls. This means that it may take some time to get through to a live person. Average waiting times are approximately 18 minutes, but they can be significantly higher on Fridays and on Monday mornings. Waiting times can even triple during filing season, and at this time of the year nearly 40 per cent of phone calls go unanswered.

However, you can still find answers to your questions and receive assistance at irs.gov. The IRS website has an interactive tax assistant tool that covers frequently asked questions on topics like tax filing, tax credits, deductions, and establishing your deductible income.

For payments online, follow these instructions:

- Go to the IRS payment page.

- Select your payment option (bank transfer, credit card, money order, etc.)

- Provide your personal and tax details

- Verify your identity to prevent fraud and scams

- Proceed with payment

You can also go online to check on the progress of your tax refund and to set up a payment plan. To file your taxes online, you will an Electronic Filing PIN. For PIN number enquiries, go to the IRS PIN Request page.

You have an account? Just fill in the login form.

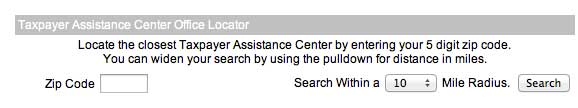

If you need further assistance or need to speak face-to-face with an agent in Texas, NY, FL, PA, GA, CA, or any other state, please use the IRS office locator.

To find the IRS office next to you, enter your ZIP code and your perimeter.

Tax-related advice and assistance is available from the IRS through the phone, online, and at your local IRS office, so simply find the method that suits your needs best and get answers to all your questions.

Get Social